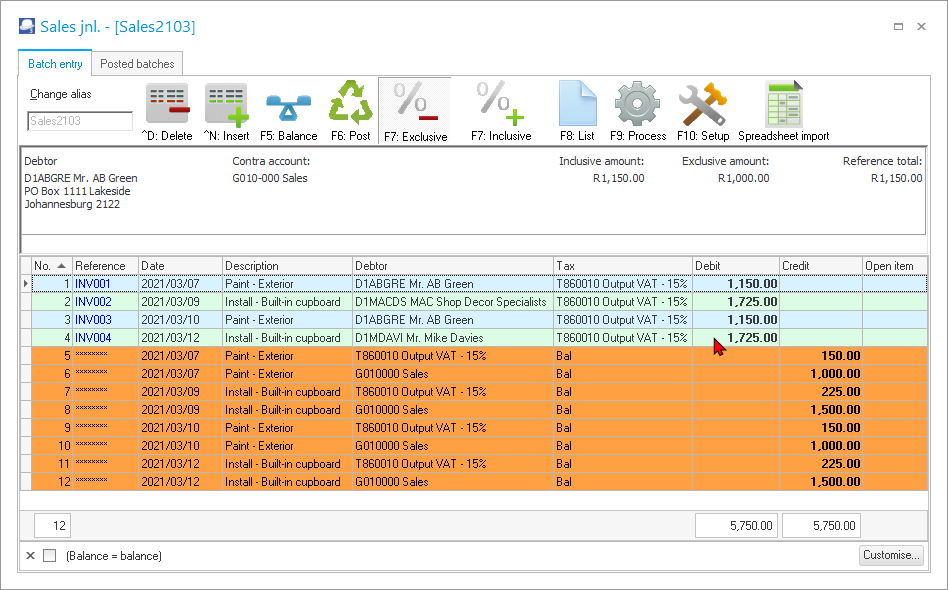

Batch entry screen

The basic layout and principles of the Batch entry screen, is as follows:

|

|

For each transaction, you need a source document from which you will enter the basic information in a Batch entry screen. We would enter the cheque number, date, to whom the payment is made, for what, and the amount of the transaction. |

Title bar

Displays the name of the selected batch accessed from the batch type screen. The name of the selected batch [between square brackets in the title bar], may be entered in the Change alias field to reflect the batch name for the specific transactions entered into the selected batch. Once the batch is posted or updated to the ledger, the batch name will make it easier if you need to identify the specific batch to print a batch type report, export the posted transactions in the posted to a file or to reverse the posted batch.

Speed buttons or icons

These speed buttons or icons are conveniently placed below the title bar on the Batch entry screen to allow you to access the most frequently used options with ease. Each of the speed buttons has a shortcut key to access the required option from your keyboard.

Column headings and rows

Column headings

Show where to enter the basic information:

|

Column heading |

Description |

|

Reference number: |

The number of the document, which contains the details of the transaction. It may be a cheque, deposit, receipt, invoice, etc. |

|

Date: |

The date of the transaction. This date must be a valid date within any accounting period within a financial year. |

|

Description: |

A brief description of the details of the transaction. |

|

Account: |

The account which must be debited or credited with the transaction. |

|

Tax: |

The tax account - the correct tax code must be selected if you are registered as a VAT/GST/Sales Tax Vendor and / or if VAT/GST/Sales Tax is not applicable to an entry or transaction. The Tax amount will be calculated automatically based on the percentage of the selected tax code. If you are not registered as a VAT/GST/Sales Tax Vendor, and / or if VAT/GST/Sales Tax is not applicable to all the transactions in the batch or journal, you may select to hide the Tax column for the specific batch or journal. |

|

Amount: |

The amount of the transaction. if VAT/GST/Sales Tax is applicable, it may be inclusive or exclusive of Tax (VAT/GST/Sales Tax), |

Rows

For each source document or transaction you need to enter the basic information in a row on the Batch entry screen.

|

|

Should you, for example, make one payment or issue a cheque for petrol and repairs and wish to allocate the petrol to one account and the repairs to another account, you need to enter each of these items (parts of a transaction) in 2 separate rows. You will still need to use one reference number (same cheque number) for both transactions. You will then have one source document (cheque) with 2 entries representing 2 transactions with the same party. |

|

|

The descriptions entered in the description fields should be entered sensibly; they should enable anybody to determine the origin and nature of the transaction. |