List batch

After entering all your transactions in a batch, and before updating or posting the transactions to the ledger, you need to print a list of the transactions entered in the batch.

|

|

This will allow you to finally check that all of the transactions entered into a batch are correct. If there are any errors, you should edit and correct them before posting the batch. |

|

|

Once the transactions in a batch are posted (updated) to the ledger, and there were errors, you need to process another transaction in another batch to correct these errors. |

|

|

It is also good practice to print a batch list, and attach the source documents (e.g. slips, invoices, etc.) from which you have entered the transactions in the batch. The reason for this is to provide an audit trail to the transactions. This will also enable you, or any auditor or inspector from your tax authority (e.g. from the Receiver of Revenue / Inland Revenue), to independently verify the transactions in your Set of Books. In accordance with various legislation (e.g. Income Tax Act, VAT Act, Companies Act, etc.), the records of account (including source documents) should be retained for a prescribed period (usually 5 years). |

You may list the entries at any time when transactions have been entered in a batch, even if the batch has been balanced or not. Before printing a list of your batch transactions, you need to decide if you wish to include the balancing entries. Should you wish to include the balancing entries on your batch list, you need to first balance the batch.

To list transactions entered in a batch:

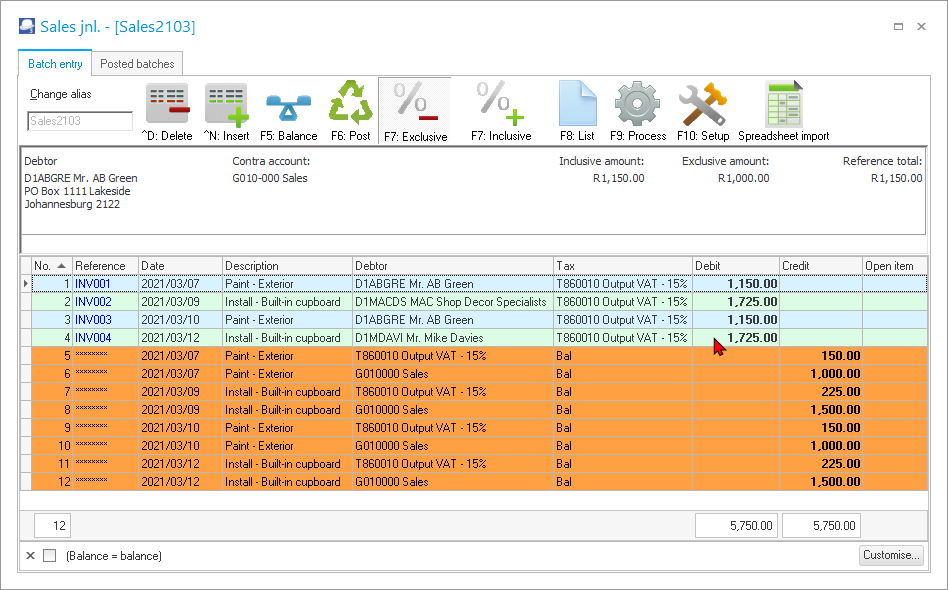

- Once the transactions are entered in a batch, you may print a list of transactions entered in the batch to check the transactions.

- Click on the F8:List icon to print a list of the transactions in the batch.

|

|

It is recommended that you print a list of the transactions after the batch is balanced and before posting the batch. |

|

|

You may also right-click on the selected batch (journal) on the Batch type selection screen, and select the Print option on the context menu. |

|

|

You may click on the F9:Process icon. You then need to select the List Batch option from the list of batch processing options. |

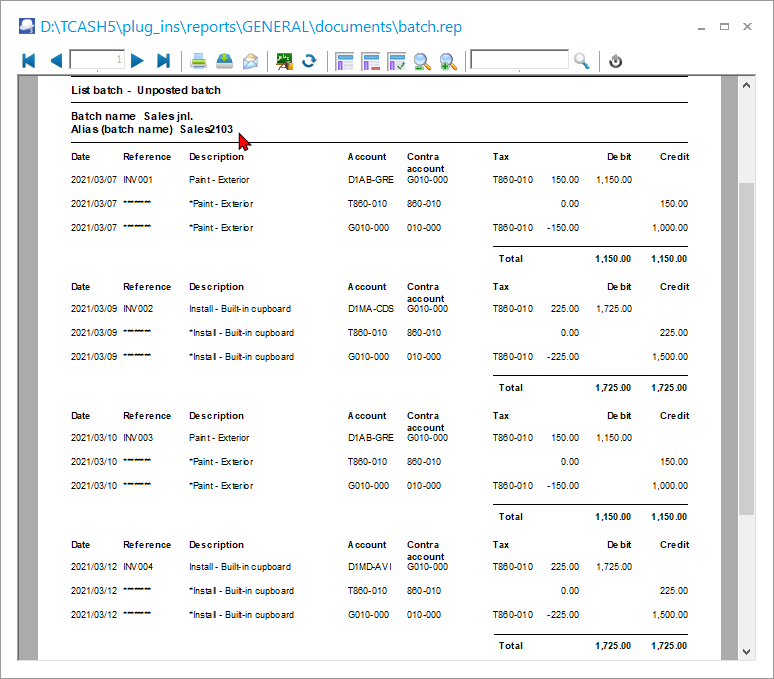

- The batch report is displayed in the "Reportman - Preview" screen:

- The details of the transactions, displayed in nine (9) columns, are as follows:

- Date - This is the transaction date as entered in the date field.

- Reference Number - This is usually refers to the source document from which the transaction is entered (e.g. the cheque number, deposit number, invoice number, supplier invoice number, etc. as entered in the Reference number field.

|

|

If a batch is balanced, the reference number will be indicated by eight asterisks (********). |

|

|

This refers to the contra account and cannot not, under any circumstances, be over typed or changed before you post the batch. |

- Description - This is the description of the transaction as entered in the description field.

|

|

This detail should be entered sensibly so as to enable any person or independent auditor to determine the nature of the transaction (what was paid, purchased, sold, etc. |

|

|

When a Creditor account or a Debtor account was selected, the descriptions should also make sense for the creditor or debtor if Creditor Remittance advises or Debtor statements are sent. |

- Account - The account code for the selected General ledger, Creditor or Debtor account will be displayed.

|

|

If a batch is balanced (if the Consolidate balancing is selected in the Options for this batch), the selected Contra account (balancing account) will be displayed. |

|

|

If any VAT/GST/Sales Tax was applicable to transactions and a Tax account or Code was selected, the Tax code would also be displayed as a balancing entry. |

- Contra account - This is the default the selected Contra account (balancing account) selected in the Options for this batch Standard tab.

- Tax - The tax code will be displayed (if tax was selected for a transaction).

- Tax - The tax amount will be displayed (if tax was selected for a transaction).

- Debit - The amount of each transaction as entered in the debit column.

- Credit - The amount of each transaction as entered in the credit column.

- After printing the report, click on the Close button.