Reverse posted documents

This facility allows you to cancel or reverse all the transactions and balances of a selected document which have been updated (posted) to the ledger. This process will automatically:

- Export (remove) the transactions from the transaction file (TransAct.DB) file, reset the totals and account balances of all the accounts (which is linked to the selected stock items on Stock items (Default ribbon), debtor or creditor accounts, stock quantities, etc.

- The reversed document may then be selected for the debtor or creditor, edited and posted to the ledger. If you do not need to update (post) the document to the ledger, you may delete the document in Edit → Delete → Documents (Default ribbon).

The balances of the accounts and stock item records will be corrected automatically for the following documents:

- Documents for Debtors (customers / clients) (Invoices or Credit notes) - debtor account, sales account, cost of sales and stock control account as well as any Output VAT/GST/Sales Tax accounts and the quantities and cost prices of any stock items.

- Documents for Creditors (suppliers) (Purchase or Supplier return documents) - creditor account, cost of sales and stock control account, as well as any Input VAT/GST/Sales Tax accounts, and the quantities and cost prices of any stock items returned to creditors (suppliers).

|

|

If a document for a debtor (customer / client) (Invoice is generated or a Quote which is confirmed and converted to an Invoice), or if a document for a creditor (supplier / vendor) (purchase document is generated an order is confirmed and converted to a purchase document ), and these documents are not yet updated (posted) to the ledger, the following options are available to edit the transactions and / or comments:

|

|

|

It is recommended that you make a backup of the Set of Books, before you start to use this facility to cancel or reverse a posted batch. In the event of making a mistake or if some problems are experienced, you may then easily restore the Set of books from the backup file. |

|

|

It is strongly recommended that you take the utmost precautions, before you use this facility. The following is a few guidelines to be taken into account, before using this facility:

|

|

|

This is of importance as the debtor (customer / client) or creditor (supplier / vendor) will receive the documents (invoice or purchase document), and record it in their books. They will then receive no source document to cancel or correct the source document received earlier in their records. If you and your debtors (customers / clients) or creditors (suppliers) are registered as VAT/GST/Sales Tax-vendors, it may have implications for VAT/GST/Sales Tax. |

To reverse or cancel all the transactions in a posted document:

- On the Setup ribbon, select Tools → Global processes → Reverse posted batch/document. The "Reverse posted batch/document" screen is displayed:

|

|

The document numbers as prefixed in the Documents setup (Setup ribbon) makes it easy to identify the document type.

|

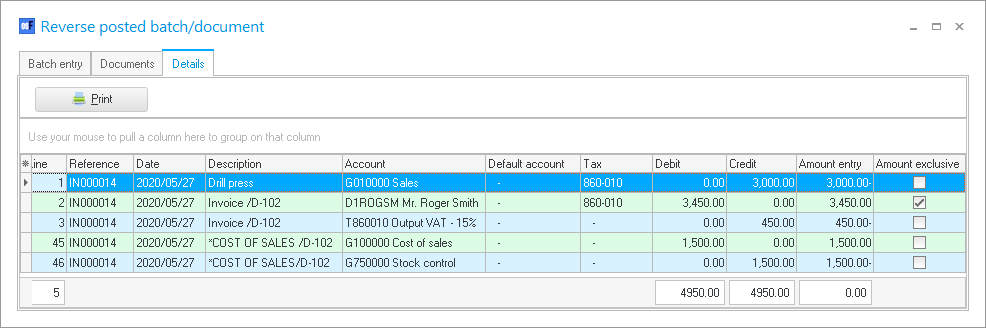

- Click on the Documents tab. The "Reverse posted batch/document" screen will change to list all the documents which are already updated (posted) to the ledger.

- Select the posted document you need to reverse or cancel from the list.

|

|

If you have more than one updated (posted) document to cancel (reverse), you may press the Ctrl key and click on each document you wish to reverse / cancel. |

|

|

If you have more than one updated (posted) document to cancel (reverse), you may click on the Select from delimited list button. For example, if you wish to cancel (reverse) Invoices IN000003 and IN000004 as well as Credit note CR000001 simultaneously, enter each of the document numbers separated by a comma (without a space) e.g. IN000003,IN000004,CR000001. If you click on the Reverse posted document button, all the selected documents will be cancelled (reversed) during the same process. |

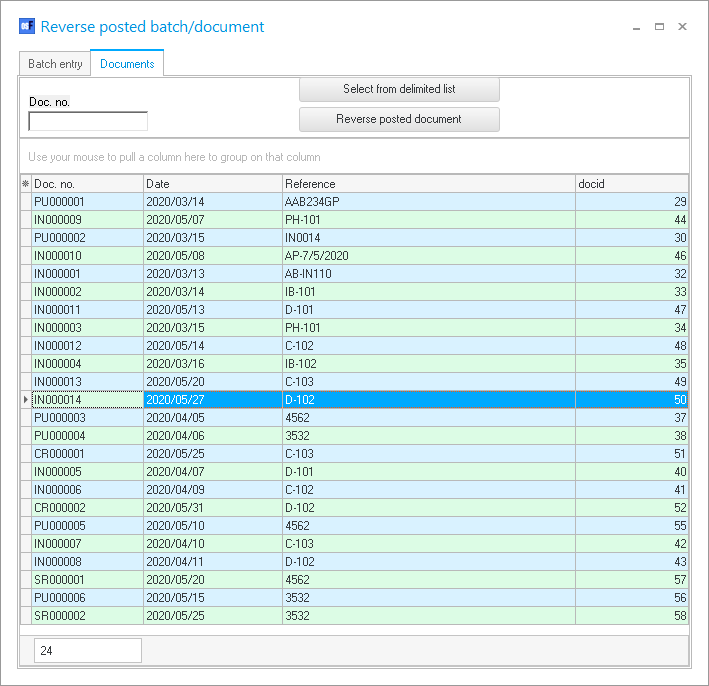

- View the details of the document(s) to make absolutely sure that it is the correct document(s).

|

|

To view the details of the transactions in the selected document(s), you may:-

|

- Click on the Reverse posted document button to start the process. The following information message will be displayed:

This will radically alter your data! We recommend that you stop and make a backup!

Do you wish to continue?

- Click on the Yes button, only if you are absolutely sure that the selected document(s) is correct, and that you need to continue with this process.

|

|

If you have not made a backup of the Set of Books before starting this process it is recommended that you click on the No button and first make a backup of the Set of Books. |

- If you click on the Yes button, the process will be started.

- Wait until the process is finalised.

|

|

A log displaying the new quantities for each stock item on the reversed documents will be displayed, for example:

You may copy this information to Notepad or your favourite text editor. |

|

|

It is advisable not to use your system for other tasks while this process is running. |

|

|

Once this process is finalised, the selected document will not be listed on the Reverse posted document screen. |

- Click on the Close button in the title bar of the Reverse posted batch/document screen.

- Click on the Invoice icon, and select the document type. If you select the debtor or creditor, for which the document was reversed, or cancelled, you may select the reversed document number. You may then edit these documents, delete the transactions, etc. Once the document is corrected, you need to update (post) the document to the ledger.