Invoices

Invoices are created for debtors (customers / clients). This will generate a source document which can be printed. The Invoice, can be edited before it is posted (updated) to the ledger.

When an Invoice is posted (updated) to the ledger, the transactions in the Sales journal will automatically be generated.

|

|

Posted (updated) Invoices cannot be edited. |

|

|

You may right-click and use the Move up, Move down and Sort on stock code options on the context menu to change the sequence of the document lines. This will change the sequence of transactions and / or comments on document layout files when printing or reprinting documents. |

If you need to cancel or correct a posted (updated) Invoice, you need to process a Credit note.

|

|

You may use the Reverse posted batch / document option on Tools → Global processes menu (Setup ribbon). The reversed document may then be selected and edited. It can then be posted (updated) to the ledger. |

The following stock item types can be selected to process Invoices:

- Default (trading stock items)

- Sales

- Sales (No stock)

- Financial entry

- Option item

- Option item (No stock)

- BOM (Bill of Materials)

- BOM (Bill of Materials) - Production

- Linked item

|

|

Quotes cannot be updated (posted) to the ledger and it generates no transactions. But, once the Quote has been converted to an Invoice, the Invoice can be edited (if necessary) and updated (posted) to the ledger. |

Options to create / edit Invoices:

- New - On the “Invoices” screen, click the New button. Select a debtor (customer / client) account on the Creditor accounts screen.

- Edit - On the “Invoices” screen, click the Edit button.

- Copy - "Documents → Copy document" or "Documents → Copy to → Invoice" option on context menu (right-click).

|

|

Convert invoice to order If you have already created invoices (whether they are updated to the ledger (posted) or not), you may convert the Invoice to an Order. To do this, select the Invoice on the documents list and right-click and select the Documents → Convert invoice to order option from the context menu. You may then edit the order and convert it to a purchase document. |

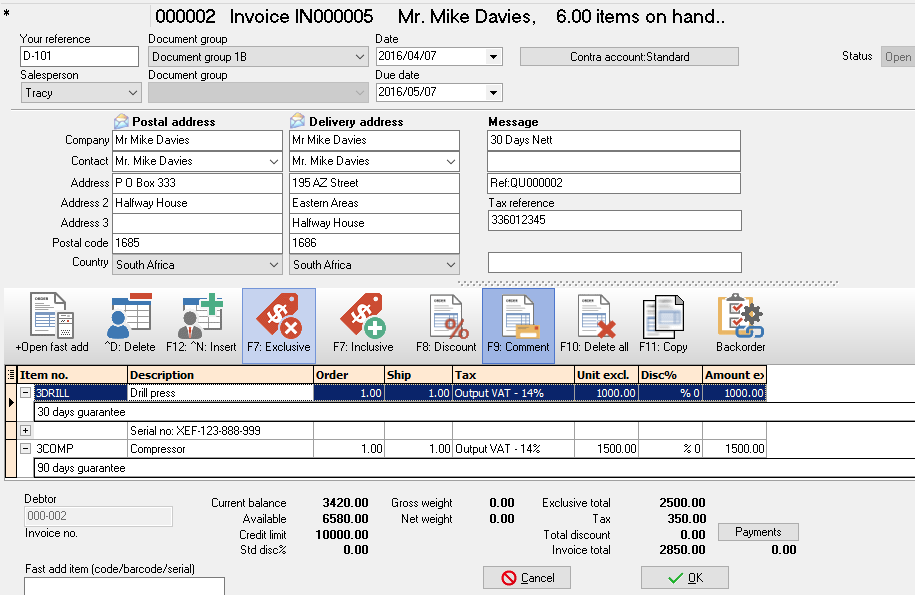

The sections and fields of the Invoice screen, is as follows:

|

|

The Backorder icon will only be displayed if a backorder is activated for stock items on invoices or quotes. |

- Document header:

- Your reference - You may enter a reference. This will allow you to track down the reference in the Search (Investigator) on the Default ribbon. All documents matching the reference will be listed.

- Salesperson - Select a Salesperson. This field is to show who handled the Invoice. The salespersons are used for reports and to filter and search documents.

- Document group 1/2 - Select Document group 1 / 2 - These groups are used for reports and to filter and search documents.

- Date - By default, the system date will be displayed. You may enter or select any other date.

- Due date - This date will be automatically be calculated. It is the “Date” plus the number of days set in the Accounting information tab of the selected debtor (customer / client) account.

- Postal address - The postal address as entered for the debtor (customer / client).

- Delivery address - The delivery address as entered for the debtor (customer / client) on the Delivery address tab.

- Message - The message, as entered in the Documents setup - Invoices tab (Setup ribbon) will be displayed. You may edit / enter messages to be printed on the document layout file.

|

|

If a Quote is confirmed and converted to an Invoice, the message as entered in the Documents setup - Quotes tab (Setup ribbon) will be displayed. You may remove or edit the Quote message. Message line 3 - Reference document numbers

|

- Tax reference - The Tax (VAT/GST/Sales tax) registration number as entered for the debtor (customer / client).

- Contra account:Standard - This is the default setting. If you click on this button, you may select a different account. The account code will then be displayed.

- Status - Open, Confirmed and Posted.

- Document lines:

- Item no. - Select a stock item.

|

|

Options to select stock items:

|

|

|

If the Financial entry stock item type is selected, the Accounts lookup screen will be displayed. The description of the selected account will be displayed. You may overtype this. |

|

|

If Abbreviation definitions were set in the Batch entry menu (F9:Process), you may enter a character (or more) to auto-complete a description in the document line. |

- Remark - You may also click on the + (before stock item code) to add a remark (additional information) for a stock item. This remark will be printed before the comment (if added) on document layout files.

|

|

Remarks are similar than comments. You may click on the + icon (before the stock code) to add a remark for the stock item. |

- Comment - You may click on the F9:Comment icon or press the F9 key to add additional information. This comment will be printed on document layout files.

- Order / Ship - The default quantity is 1. You may overtype the quantities.

- Unit price - If cost prices have been entered in in the Cost price field for the selected stock item, the cost price will be displayed. Cost prices Exclusive of VAT/GST/Sales Tax, if the F7:Exclusive icon is active - or Inclusive of VAT/GST/Sales, Tax if the F7:Inclusive icon is active.

- Discount - You may enter the discount percentage for the item.

- Amount exclusive - This will is the quantities in the Order and Ship field x Unit price. If any discount percentage is entered, the discount will be deducted from the unit price.

|

|

You may use the F11: Copy feature to copy the document transactions / comments from an existing document. |

- Document footer:

- Fast add item (code / barcode / serial) - Enter the stock code, barcode or serial number. Press enter to add the item to the document lines.

- Current balance - The balance of all posted and unposted documents for the debtor (customer / client).

- Available - The available balance is calculated as the Credit limit minus the Current balance. When processing documents, and the credit limit is exceeded, a warning message will be displayed.

- Credit limit - The credit limit as entered for the debtor (customer / client) on the Accounting information tab.

- Std disc% - Standard discount percentage is only applicable to debtor (customer / client) accounts. The discount percentage as entered for the debtor (customer / client) in the Customer discount field on the Accounting information tab.

- Click on the OK button.

|

|

By default, a confirmation message “Do you wish to print this invoice?” will be displayed. You may turn this feature off by selecting the "No print confirmation" option on Stock information (Setup ribbon). |

- Click on the Yes button to print the Invoice.

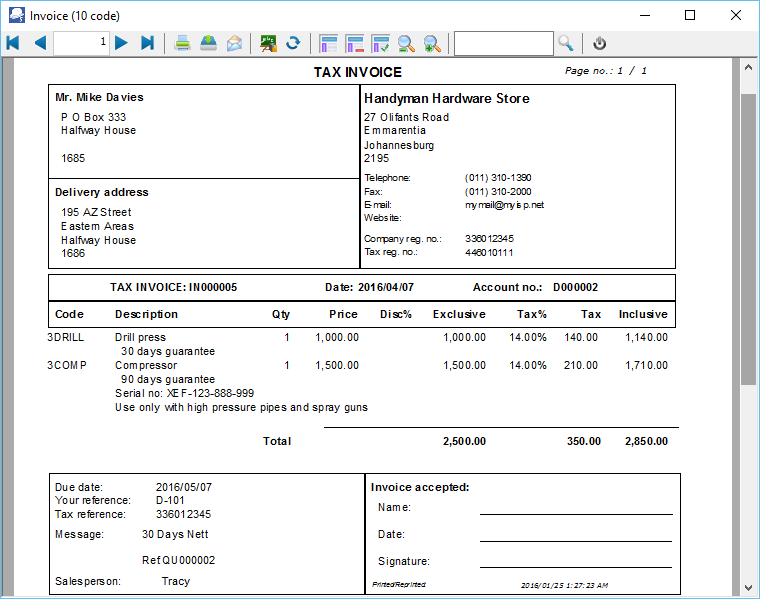

An example of the printed Invoice, is as follows:

|

|

Remarks is implemented in TurboCASH5 (Build 969) and added to document layout files. Remarks are similar to comments. You may click on the + icon (before the stock code) to add a remark for the stock item. |

|

|

This example is based on the Invoice (10 code). You may also select the following available order layout files: - Invoice (15 code) - Invoice (no codes) - Invoice A4 (10 code) - Invoice A4 (15 code) - Invoice A4 (no codes) - Invoice A4 Plain (10 code) - Invoice A4 Plain (15 code) - Invoice A4 Plain (no codes) |