Automatic payments

Automatic payments - To be advised.

Electronic banking transactions

Pay creditors

You may pay your Creditor accounts via the electronic banking system. The transactions for creditors with outstanding transactions and balances will be transferred into the Pay Creditors screen, where you may select the creditors and outstanding amounts you need to pay.

The creditors which have open or outstanding amounts will be listed. The (outstanding amount) balances are transferred to an intermediate account or clearing account on the date of the transactions.

Once the payment is cleared at the bank (on the due date) payment is deducted from the Bank account and will appear on the bank statement. When you allocate the transaction on the bank statement, the intermediate account or clearing (account contra account) will be debited.

|

|

Before using this feature, bank accounts need to be entered the Accounting information tab of Creditor (supplier / vendor) accounts (Default ribbon). |

To pay creditor (suppliers) using the Automatic payments feature):

- On the Default ribbon, select Batch entry (F2).

- Select the General journal or any other batch type.

- Click on the Open button. The Batch entry screen for the selected batch will be displayed.

- Enter the Alias (batch name) and press the Enter key, if necessary.

- Click on the F9: Process icon. The "Process the batch" options screen will be displayed.

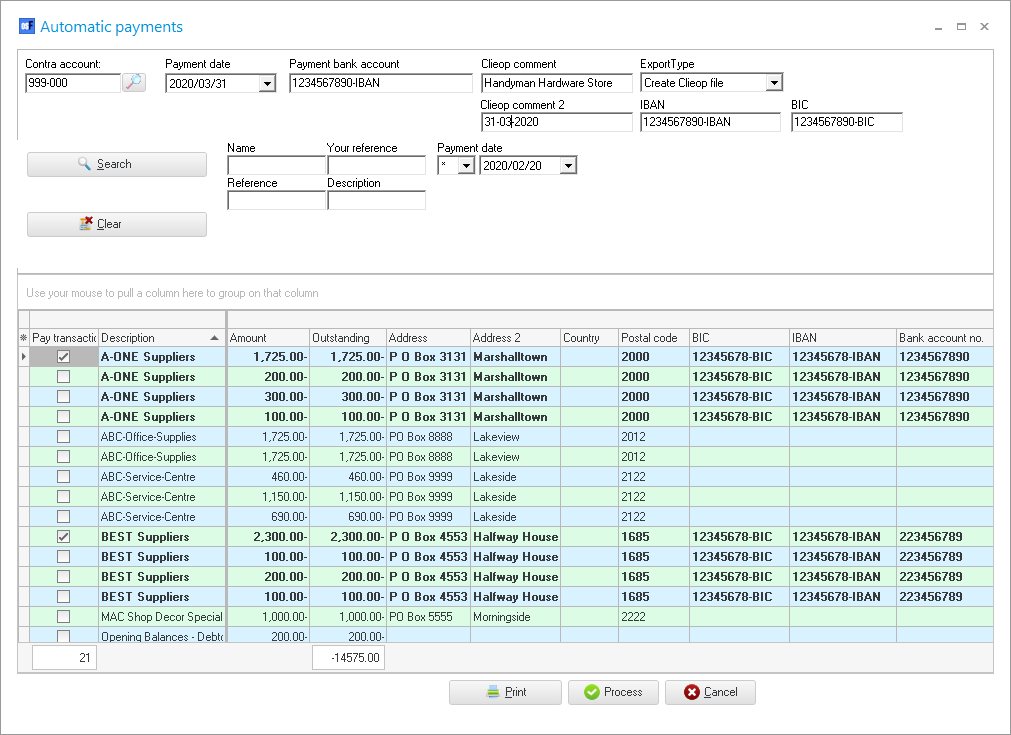

- Select the "Automatic payments" option, and click on the OK button. The "Automatic payments" screen is displayed:

- All the creditors (supplier) accounts with transactions will be imported.

- Select and enter the following:

- Contra Account - Select the intermediate account. This is basically a clearing account for the payments to creditors.

|

|

It is recommended that a General ledger account, which is linked to the Current liabilities Account group be selected. |

- Payment Date - Enter or select the date for which you need to process payments for Creditor accounts.

|

|

The transactions on this date to the intermediate account or clearing account (Contra account), and calculate the due days as specified in the Due days field on the Accounting information tab of the selected creditor (supplier / vendor) account. |

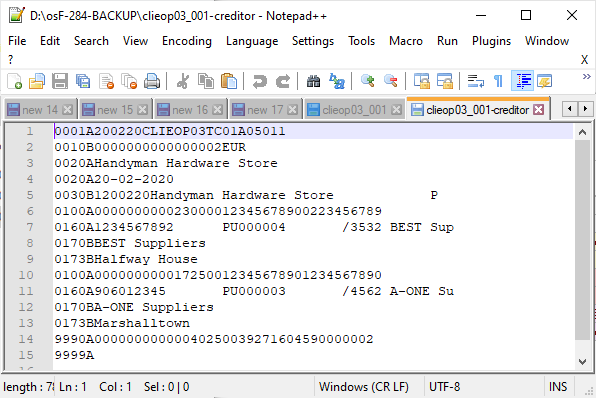

- Create Clieop File - If you select this option, you need to specify the name for the Clieop file.

|

|

The Clieop file is a general accepted file format that can be read into a bank program for payments. |

- Payment Bank Account - Enter the payment Bank account.

- Clieop comment - Enter a comment for the transaction.

- Check that the payment information and outstanding amounts for each creditor is correct.

|

|

If you do not wish to pay a creditor at this stage, deselect (remove the tick) the Pay transaction field next to the selected creditor. If the Pay transaction field is not selected, no transactions will be generated for the creditor and the creditor will be excluded from the Creditors payment report. |

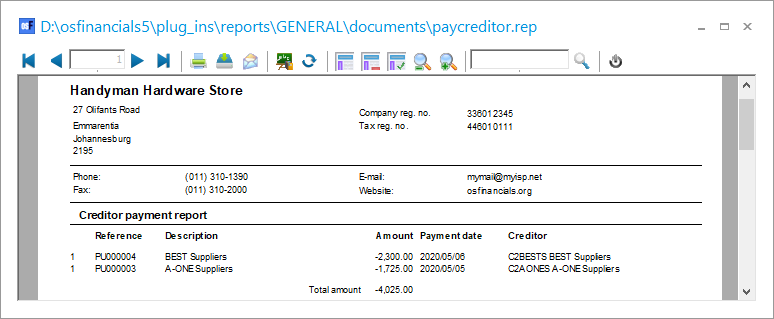

- Click on the Print button to generate a Creditor Payment report for all Creditor accounts with outstanding amounts (balances) for which the "Pay transaction" field was selected. An example of the "Creditor payment report", is as follows:

- Click on the Update button. All Creditor accounts with outstanding amounts (balances) for which the "Pay transaction" field was selected will be imported into the selected batch (journal).

To Save the Creditor Payment Report:

- If the Clieop file field was selected, the "Save As" screen will be displayed if you click on the Update button of the "Automatic payments" screen.

- Select the directory in which you need to store the file and specify the name for the file.

|

|

The default file name is Clieop followed by the date (YYMMDD - format) with a *.dat file type or format. |

|

|

- Click on the Save button to save and generate the Creditor payment report. An example of the Creditor payment report is as follows:

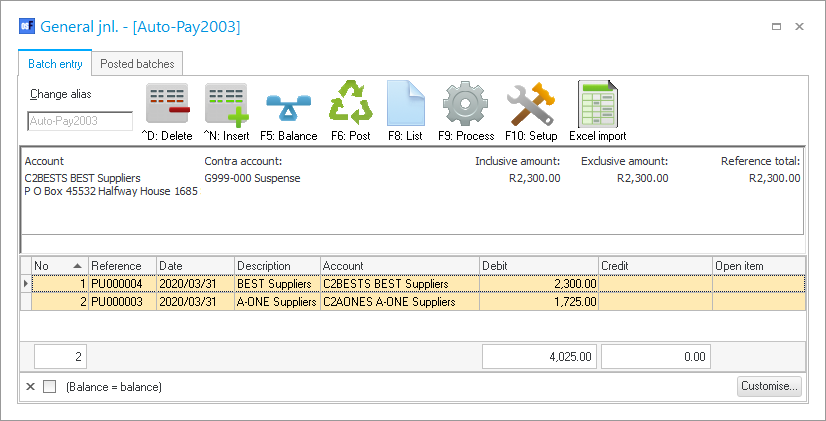

- When you close the report, the transactions will be generated and imported for all creditors selected as pay transaction. An example of the imported creditor payment transactions, is as follows:

- Once finished, change the reference number, as generated by TurboCASH, with your own reference numbers (e.g. electronic payment reference, or other reference number, as it would appear on your bank statements).

|

|

Once you have finished entering / editing the transactions in the batch you need to: -

|

|

|

You may use the "Creditor balances at date" batch processing option to generate all Creditor accounts with outstanding balances as at the specified date. The transactions will automatically be imported into the Payments journal. |