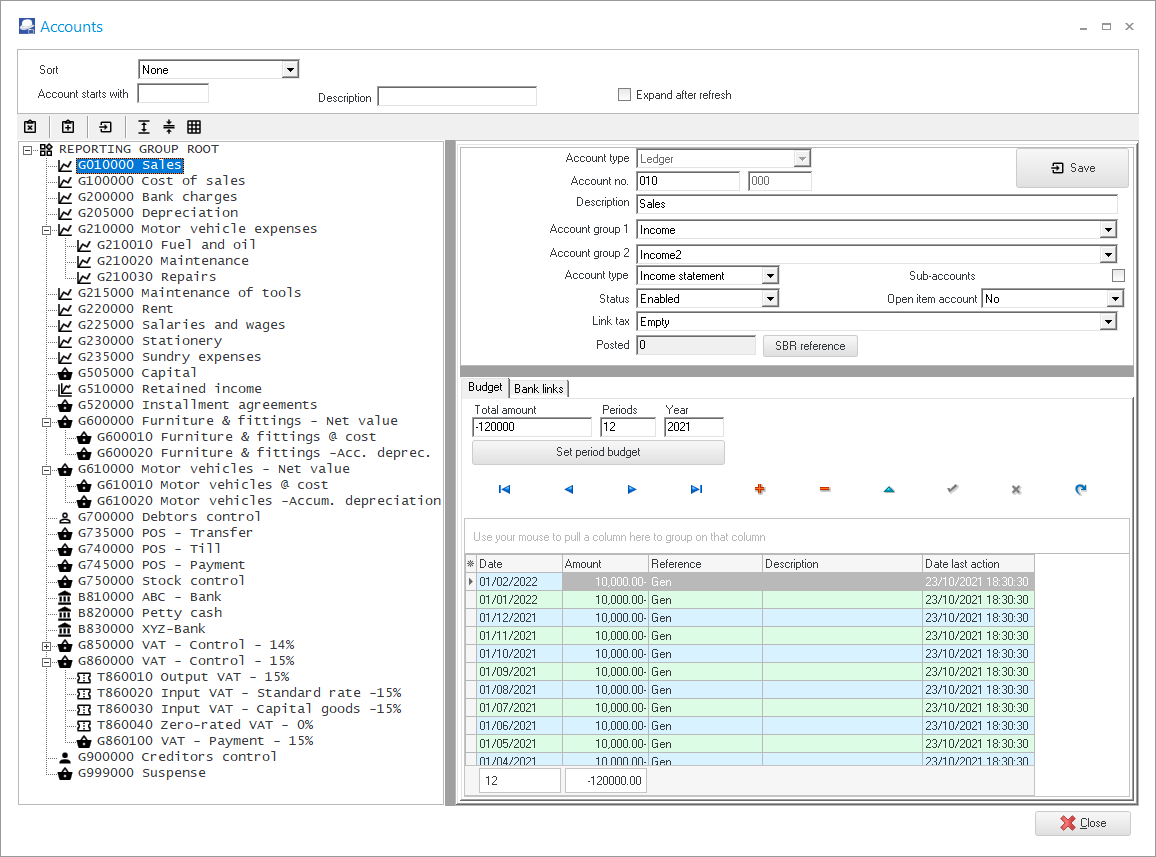

Accounts (Ledger)

The Chart of accounts lists all the accounts (Ledger, Bank and Tax account types) in the general ledger which is either reported in the Trial balance (Income statement and Balance sheet). The chart of accounts is further structured by linking each account to a reporting groups (Account group 1 or Account group 2). Each of these Account groups needs to be linked to a financial category. It is important to plan the Chart of accounts and to link accounts to account reporting groups and financial categories, since this is the core of managing your budgets, business activities and managing your business on the financial reports.

The fist step, after installing TurboCASH5, is to find a Set of Books (template) that matches your requirements.

|

|

Depending on your choice of the country and language on the "Select country and language" screen; when you have installed TurboCASH5, one or more Set of Books for the specific country and language will be installed. The Open Set of Books screen will list only those Set of Books which is installed. These installed Sets of Books us stored in the "... / books" folder of your TurboCASH5 installation. If the Chart of accounts and / or correct language, is not installed, you may Browse and open a Set of Books that is more suitable for your requirements. All the Sets of Books (templates) is included in the TurboCASH5 install, including those not installed for your selected country, is stored in the "... / bin / Repository" folder. Once you have selected your Set of Books, go to Save as on the Start ribbon, to edit your Chart of accounts. |

The accounts structure in all of the Set of Books templates ( "... / bin / Repository" folder) consists of 3-digit main accounts and 3-digit sub-accounts, except for the following Sets of Books:

|

|

Books with 4-digit main account and 3 -digit-sub-accounts |

|

Books with 5-digit main account and 3 -digit-sub-accounts |

|

|

EN-CANADA-CORPORATION |

|

EN-USA |

|

|

EN-CANADA-OTHER |

|

EN-USA CALIFORNIA |

|

|

After opening a Set of Books, you may print a list of the Chart of accounts from the following options:

|

All ledger accounts, including budgets is maintained in the Budgets on the Reports ribbon or in the Setup → Accounts on the Setup ribbon. Once your chart of accounts is set and linked, you may edit your chart of accounts:

- Ledger accounts - Income and Expense and Balance sheet account types; which include the following account types:

- Bank accounts - Bank accounts, including Petty cash accounts

- Tax accounts - Correct tax rates and terminology for your country. If Tax rates changes, you need to change the tax rates.

- Budgets - Enter and edit budget figures. Budgets may also be entered and edited in the Setup → Accounts on the Setup ribbon.

|

|

If you have added a Financial entry stock item type, you may select a general ledger account, debtor (customer / client) account or a creditor (supplier / vendor) account from the Accounts lookup when processing documents. |

It is important to note the types of accounts, which will be reflecting in your List of Accounts (Chart of accounts) as you will create, edit and delete accounts in Setup → Accounts (Setup ribbon):

|

Account type |

Brief description of the Account type |

|

Bank accounts should be linked to a Receipts and Payment Journal batch. |

|

|

Accounts are aligned to either an The

|

|

|

Accounts containing the Tax percentages and dates for which those tax percentages are effective. These are the Output Tax and Input Tax codes. These are country specific and should contain the VAT / GST / Sales Tax terminology and codes as prescribed by the tax authority of your specific country. |

Creditor (supplier / vendor) and Debtor (customer / client) accounts, are created, edited or deleted in Default ribbon.

|

Menu option |

Brief description of the account type |

|

Creditor (Supplier) accounts containing the details of the creditors, remittance advice messages, contacts, land terms. It also contains detail of processed transactions and a list of purchase documents (i.e. Purchases, Supplier returns and Orders). The total of all individual accounts in the Creditor's ledger will be displayed as the Creditor's control account in the General ledger. |

|

|

Debtor (customer / client) accounts containing the details of the debtors, statement messages and terms. It also contains detail of processed transactions and a list of sales documents (i.e. Invoices, Credit notes, Quotes and Point-of-Sale Invoices). The total of all individual accounts in the Debtor's ledger will be displayed as the Debtor's control account in the General ledger. |